Latest Publications

Why is The “Rent So Damned High”? explores the drivers of high and rising rents and proposes a series of policies to address rental unaffordability in New Jersey and respond to changes at the federal level. Most experts say the chief explanation for high rents is an undersupply of housing and push a “build, build, build” strategy to bring rents down. Our findings challenge the consensus. Through a deep dive of academic and public research, we identified four primary drivers of high and rising rents: inflation, undersupply, widening inequality, and the consolidation and professionalization of landlords and real estate.

Federal policy is embracing building as the foremost solution to the affordability crisis. Trump’s Big Bill permanently expanded the country’s largest affordable housing production subsidy program, the Low-Income Housing Tax Credit (LIHTC). Meanwhile, deeper subsidy programs that can reach low-income renters are threatened with large cuts. To make housing affordable, we must also address stagnant incomes and the consolidation of homebuilders and landlords.

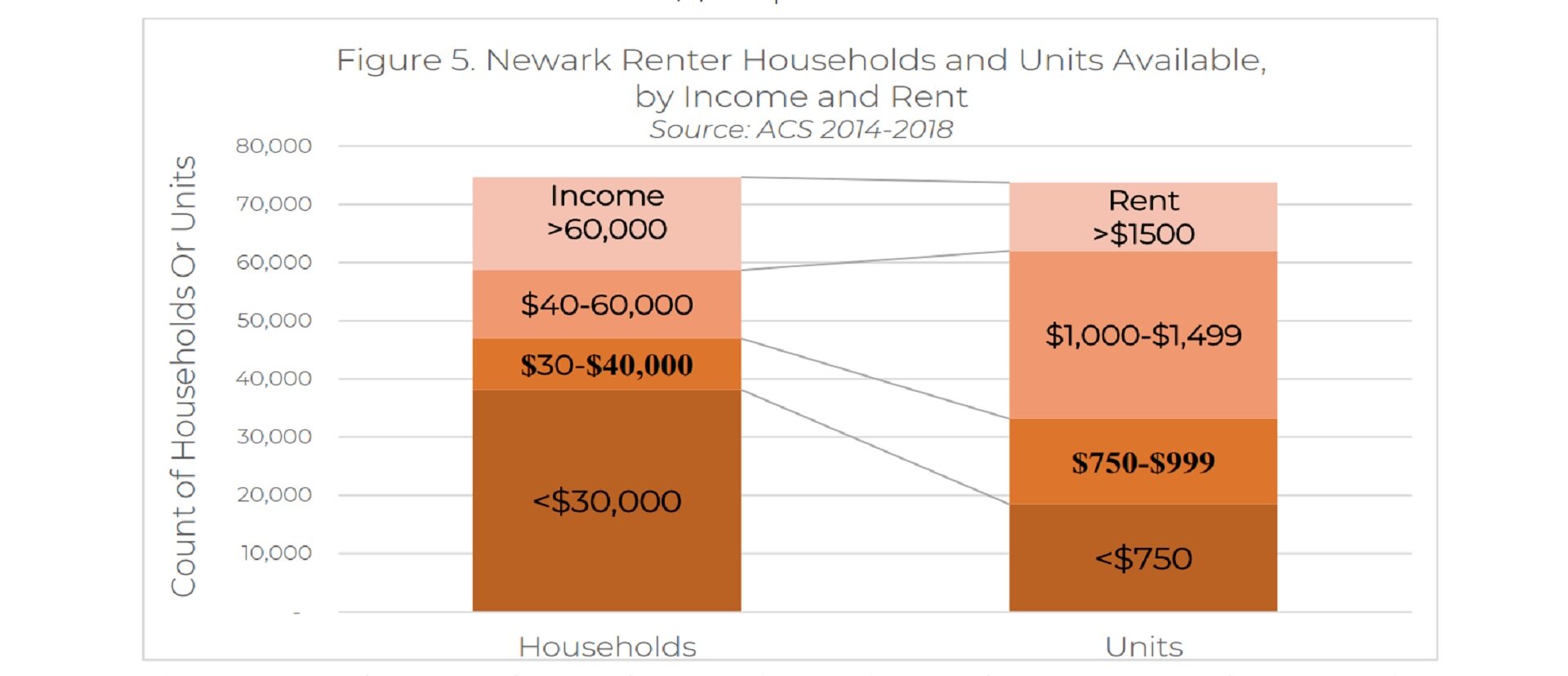

Diverging Dynamics: The 2023 Displacement Risk Indicators Matrix (D.R.I.M.) Update for Newark explores how the risk of displacement in Newark has changed since 2010. Newark is experiencing the steady erosion of affordability as rents rise faster than incomes. In this latest installment of CLiME’s displacement analysis, diverging patterns of urban change are becoming clearer across wards with uneven but unmistakable signs of gentrification.

The East and Central Wards saw the most dramatic increases in new construction activity, the most rapidly rising rents, and the most pronounced increases in residents who are college-educated and/or affluent renters. The West Ward also shows signs of elevated renter vulnerability, with large increases in medium household incomes alongside rising rent burdens. The North Ward has very different housing market dynamics, with large increases in homeownership and much less residential construction. The South Ward shows the greatest signs of tenant vulnerability but also has the most affordable rental stock, compared to other parts of the city.

Rewriting Racial Inequality: The State of Civil Rights Law under Trump documents the second Trump administration’s blueprint for radically transforming how the federal government views and enforces civil rights. The new legal order taking shape upends Reconstruction-era understandings of equal protection and related federal statutes while recasting the modern Civil Rights Movement as a defense against anti-white race discrimination. Our close and comprehensive examination of executive orders, enforcement activity and litigation since January 20, 2025, organizes the Trump administration’s approach into four pillars: (1) Redefining racial discrimination, (2) Dismantling the institutional framework for government support of racial equity and cancelling existing investigations, (3) Enforcing policy priorities through defunding and fining institutions, and (4) Encouraging racial gerrymandering of congressional districts in the guise of political gerrymandering.

Under this framework, we explore how the Trump administration has built on prior conservative doctrinal developments in civil rights law to:

Offer a new interpretation of anti-discrimination based solely on an exaggerated application of Students for Fair Admissions v. Harvard that paints Black and brown people as the grantees of unmeritocratic preference and white people as the victims of discrimination;

Fire tens of thousands of federal employees and shuttered or incapacitated most federal agencies, offices, and programs focused on civil rights or equity;

Halt or cancel thousands of civil rights investigations, particularly claims of race discrimination, while prioritizing and opening new investigations for discrimination against white people and antisemitism;

Terminate, condition or freeze hundreds of billions of dollars in funding to states, universities, rural and low-income schools, nonprofits supporting vulnerable populations, groundbreaking scientific research, and programs explicitly created by Congress, all because they were identified as DEI-related and thus no longer effectuated Trump’s priorities;

Present an erroneous legal finding of voter discrimination in order to force a hesitant state legislature to redistrict, resulting in a racial gerrymander.

As a result, affected individuals, states, organizations, law firms and universities either sought resolution with the administration, hoping to avoid the public and financial costs of litigation, or fought the administration in court. Hundreds of challenges are ongoing in federal district courts throughout the country, with some claims successful in winning back their positions, grants, or constitutional protections, while others, denied relief often because of the Supreme Court, face the long-haul litigation battle. We chronicle these struggles for policymakers, researchers, students and the public at large.

The societal implications of these developments include the stereotyping of Black identity and the abandonment of racial remediation efforts; turmoil in the federal courts and a lack of consistent legal standards; a diminished federal rights infrastructure; and more culture war.

Rewriting Racial Inequality offers a rare focus on issues of racial equality as a fundamental interest, anti-Black racism and the Trump administration’s civil rights playbook at the crossroads of antidiscrimination law. This critical evaluation is intended as a resource and will be updated in six months.

The Supreme Court’s decision in Students for Fair Admissions v. Harvard reshaped the constitutional landscape of higher education while leaving important questions of educational mission unanswered. By undermining diversity as a compelling interest under strict scrutiny judicial review, the Court dismantled the decades-long framework under which universities adopted admissions practices in pursuit of self-defined institutional goals. That model may fit elite private institutions like Harvard or UNC, but it fails to capture the full spectrum of American higher education.

This brief proposes that land-grant universities possess a distinct institutional interest in cultivating a diverse student body. This interest is grounded in their statutory mission, the historical purpose of the Morrill Acts, and the judicial deference traditionally afforded to congressional mandates that create and continue to govern land-grant institutions.

SFFA’s reasoning may be too rigid to accommodate the genuine diversity of institutional missions in American higher education. Recognizing this doctrinal blind spot is only the beginning of a broader scholarly conversation.

Metropolitan areas in New Jersey need to dramatically lower their building emissions to combat climate change and protect local health. However, metropolitan New Jersey faces several major challenges. First, federal and state law preempt New Jersey municipalities from adopting some stricter laws that could lower building emissions. Second, competition between municipalities creates a collective action problem that disincentivizes legal reform. Third, building emission reduction strategies can create unintended harm such as worsened indoor air quality and gentrification. To avoid these challenges, individual New Jersey municipalities can utilize metropolitan equity strategies to cooperate efficiently. However, the most impactful way New Jersey can decarbonize buildings may be for the state legislature to amend its building emissions benchmarking law to enable the state government to decarbonize buildings more effectively.

Featured Videos

CLiME Director David Troutt on CBS This Morning: “Confronting the history of housing discrimination” February 19, 2021

Keynote speech at Rutgers Center on Law, Inequality and Metropolitan Equity (CLiME) Trauma, Schools and Poverty Conference: How Systems Respond to Traumas of Young Lives. Susan F. Cole, Trauma, Learning and Policy Initiative at Harvard Law School.